December Quarter 2024 Review: Post election rally short-lived

- Mark Gibson

- Jan 21, 2025

- 4 min read

Updated: Aug 29, 2025

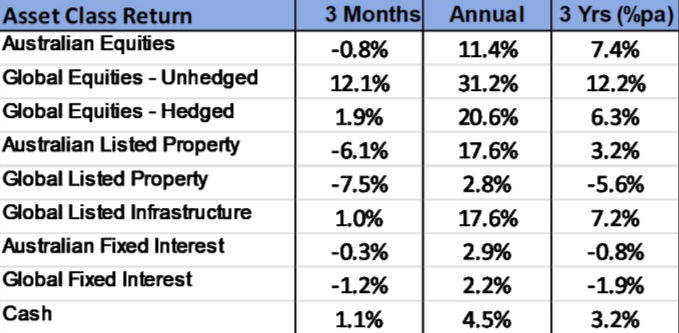

Global equity markets responded positively to the clear-cut U.S. election result.

However, concerns that US cash rates will not fall by as much as previously expected caused bond yields to rise and US equity valuations to decline towards the end of the quarter.

Further weakness in the $A resulted in currency related gains for Australian investors with unhedged global exposures.

International Equities

Global equities rallied strongly mid-quarter following the Republican victory in the U.S. Presidential election. The clear-cut election result was viewed positively as it removed a source of uncertainty and set-up a reduction in US corporate tax rates and deregulation initiatives.

However, some of November’s gains were reversed in December. The main catalyst for the change in share market direction appeared to be a shift in the outlook for interest rates, with fewer U.S. cash rate reductions now expected.

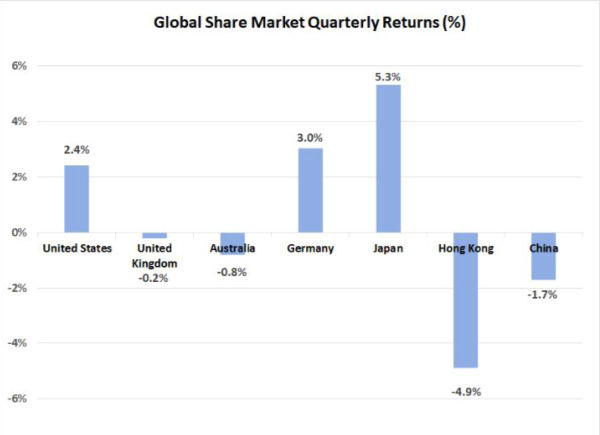

Within U.S. equities, it was once again the large technology stocks that outperformed, with the sector gaining 5.7% for the quarter – well ahead of the broader S&P 500 Index increase of 2.4%. Tesla was particularly well supported following the U.S. election result, with the stock posting a quarterly share price increase of 54.4%.

Smaller companies also rallied strongly following the election but were heavily impacted by the change in interest rate outlook, with the U.S. Russell 2000 Index finishing flat for the quarter.

Outside of the US, the concern over higher interest rates was less significant and share market performance was mixed. Germany (up 3.0%) and Japan (up 5.3%) generated gains. Japan’s performance was positively impacted by an announcement indicating the Japanese Government Pension Investment Fund was increasing its return target, which could result in a higher allocation to Japanese equities.

The decisive election result had a negative impact on emerging markets. The prospect of increased tariffs and a strengthening in the $US, weighed heavily on emerging market sentiment, with the MSCI Emerging Market Index dropping in value by 4.6%. The Chinese market pulled back from the strong gains recorded in the month of September, when an economic stimulus program was announced.

Tariff expectations also impacted on commodity markets, with further weakness in the iron ore price being detrimental to the Brazilian market, which declined 10.1% over the quarter.

Higher bond yields had a significant impact on listed property. With yields becoming less attractive on a relative basis as bond yields increased, global listed property declined by 7.5% and Australian listed property was 6.1% lower. Infrastructure, however, was better supported, posting a gain of 1.0% for the quarter.

Australian Equities

Australian equities underperformed over the December quarter, with the S&P ASX 200 Index falling 0.8%. Resource stocks continued to lose ground, with falling iron ore prices weighing on the large mining

companies. Weakness continued in the energy sector as oil prices remained at low levels despite the ongoing conflict in the Middle East. Energy stocks fell 5.4% over the quarter. Resource and energy stocks have now declined by 14.9% and 13.9% respectively over the past year.

Also heavily detracting from returns last quarter were consumer staple stocks. A weaker than expected trading update from Woolworths (down 8.4%) was the main contributor for the sector’s decline.

In contrast, the financial sector made a strong positive contribution to the asset class last quarter. Banks continued to be well supported, despite lofty valuations. There was also strong growth in the price of insurance stocks, with earnings being supported by higher premiums.

Fixed Interest and Currencies

Cash rates continued to decline with monetary policy easing around the globe last quarter.

The U.S. Federal Reserve reduced its cash rate by 0.25% in each of November and December, with the rate now operating in a range between 4.25% and 4.5%.

However, a more “hawkish” tone from the Federal Reserve Chairman in December pushed back expectations of further rate reductions, with ongoing buoyant economic conditions making lower inflation and further rate reductions less likely. Longer term bond yields increased as a result, with the U.S. 10-year Treasury Bond yield increasing from 3.81% to 4.58% over the quarter.

Australian yields, however, were somewhat more stable, with ongoing weakness in the local economy still providing an opportunity for a lowering of the cash rate in early 2025. None-the-less, Australia’s 10-year Government bond yield still increased 0.41% over the quarter to finish at 4.37%.

The election result and a higher interest rate outlook in the United States provided a source of support for the $US last quarter. As a result, the $A declined from U.S. 69.3 cents to U.S. 62.2 cents.

The $A also declined against the Euro and Japanese Yen, by 3.8% and 1.1% respectively. With commodity prices remaining relatively soft and local interest rates expected to fall, there has been a decline in support for the $A over recent months.

However, for investors with unhedged currency exposure attached to overseas investments, this has been a source of significant gain over the past quarter.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR, MSCI World ex Australia NR Hdg AUD, FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A- REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HKD, MSCI United Kingdom TR in GBP, Nikkei 225 in JPY, S&P 500 TR in USD.

General Advice Disclaimer

This document has been prepared by Sage Advisers. Sage Advisers is a Corporate Authorized Representative of Sage Advisers Pty Ltd (AFSL 238039). Any advice provided is of a general nature and does not take into account personal circumstances. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Should the reader wish to avail of using the above investment philosophy they should only do so firstly seeking personal financial advice through a financial planner. Past performance is not a reliable indicator of future performance.

Comments