June Quarter 2025: Share markets bounce back strongly

- Mark Gibson

- Jul 15, 2025

- 4 min read

Share markets bounced back strongly over the June quarter, despite renewed tensions in the Middle East and ongoing U.S. tariff policy uncertainty.

The U.S. dollar continued to weaken with the Euro appreciating.

Bond yields moved lower, as expectations of a U.S. cash interest rate cut firmed.

International Equities

Following a very sharp sell-off in early April in response to the “Liberation Day” tariff announcements, global equity markets bounced back strongly over the remainder of the June quarter. Hopes that a pause in the tariff program would allow a much more moderate negotiated outcome buoyed markets. Also adding to investor confidence was the expected passing of the “One Big Beautiful Bill Act” through the U.S. Senate. This legislation provides a source of fiscal stimulus to the U.S. economy and is seen to lower the probability of a recession in the near term. The S&P 500 Index slightly outperformed the global average with a gain of 10.9%. European markets were also well supported, particularly during the period of heightened concern over the U.S. tariff program. Similarly, the Japanese market gained strong support, with the Nikkei Index rallying 13.8%.

Gains on emerging markets were also solid but trailed those on developed markets. Uncertainty over the impact of the very significant tariff rates announced by the U.S. on Chinese imports detracted support from the Chinese share market, which recorded a modest gain of 2.4%.

There were further tensions and military activity in the Middle East last quarter, with both Israel and the U.S. striking nuclear facilities in Iran. Although this activity had minimal impact on share markets, there was significant volatility in the oil price. After falling early in the quarter, the oil price jumped 7.1% in the month of June. This spike in the oil price was initially prompted by fears that Iran could take action to close the Straits of Hormuz, which cater for 20% of total global oil trade.

With the quarter being one of high volatility, the more defensive sectors of the equity market performed well. This led to gains to gains for global infrastructure stocks, which advanced by 6.7%. Over the past 12 months, infrastructure has been the best performed of the major asset classes, posting a return of 23.7%. Listed property has also been well supported, assisted by the outlook for lower interest rates.

Australian Equities

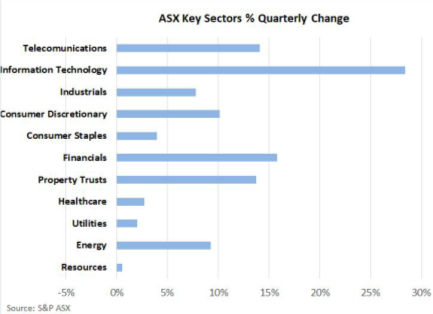

Australian equities performed closely in line with the global average over the June quarter, with the S&P ASX 200 Index rising 9.5%. Consistent with the strong global support for the sector, technology stocks were the strongest performers, rising by 28.4% over the quarter. Financial stocks also made a solid contribution, with CBA (up 22.4%) hitting new record highs. For the 2024/25 financial year as a whole, CBA gained 49.8%, which compares to an average of 17.8% for the other 3 major banks.

Despite oil prices falling over the quarter, the energy sector advanced nearly 10%, with a takeover bid for Santos (up 15.0%) adding support. Other resource stocks were less impressive, with a 7.8% decline in the iron ore price, and a rising $A, leading to a decline in earnings expectations across a number of mining stocks.

Fixed Interest and Currencies

Interest rates have continued to decline. Australia’s cash interest rate was reduced from 4.10% to 3.85% following the Reserve Bank’s May Board meeting. The lower rate follows a reversion in Australia’s inflation back towards the RBA’s long term 2% to 3%

target. Expectations remain strong that monetary policy will continue to be eased around the globe.

Despite the potential inflationary threat from tariffs and increasing concern over the size of the U.S. budget deficit, longer term yields in the U.S. finished the quarter largely unchanged, after rising in April. 10-year U.S. Treasury Bond yields rose by just 0.01% over the quarter to 4.24%. There was more downward momentum in Australian yields, with the 10-year government bond rate dropping from 4.38% to 4.18% over the quarter.

The $US was on a downward trend last quarter, enabling the $A to appreciate from U.S. 62.8 cents to U.S. 65.5 cents. The $A was also 0.7% stronger against the Yen but declined 3.6% relative to the Euro. The Euro has been the best supported of the major currencies, having appreciated 12.7% against the $US since the end of December. This is despite cash rates declining in Europe over this period. As such, the Euro appears to have taken on a “safe haven” type status, potentially providing investors with some diversification away from U.S. policy risks and uncertainties.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR, MSCI World ex Australia NR Hdg AUD, FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A- REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HKD, MSCI United Kingdom TR in GBP, Nikkei 225 in JPY, S&P 500 TR in USD.

General Advice Disclaimer

This document has been prepared by Sage Advisers, trading as “Brad Matthews Investment Strategies” (BMIS). Sage Advisers is a Corporate Authorised Representative of Sage Advisers Pty Ltd (AFSL 238039). The document is intended for the use of financial adviser clients of BMIS and their staff only. Any advice provided is of a general nature and does not take into account personal circumstances. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Past performance is not a reliable indicator of future performance.

Comments