June Quarter 2024 Review: Global inflation fears subside

- Mark Gibson

- Jul 18, 2024

- 4 min read

Updated: Aug 29, 2025

Concerns in April that sticky inflation would delay interest rates cuts subsided over May and June.

Global equities continued to be led higher by the technology sector.

Australian equities underperformed as some commodity prices as resource stocks weakened.

International Equities

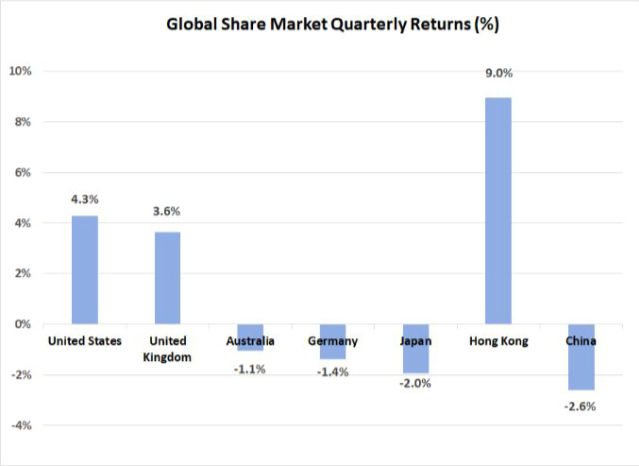

News of higher-than-expected U.S. inflation in April saw global equity markets sell-off and bond yields initially adjust upwards. However, more favourable inflation data released in the following two months restored market confidence and global equity markets then more than reversed April’s decline.

Over the quarter, developed market equities averaged a 3.0% gain to bring the annual increase to 20.2%. The pattern of price growth over the quarter was like that prevailing for most of the past year, with the United States technology sector leading the market higher. Large tech stocks in the U.S. rallied 12.6% over the quarter, significantly outperforming the overall S&P 500 Index gain of 4.3%.

Once again, the market’s focus was on computer chip manufacturer Nvidia, which became the largest listed company in the world in June based on market capitalisation (which is the share price multiplied by the number of shares on issue) following a quarterly gain in its share price of 36.8%. Actual earnings results and forecasts across the U.S. technology sector have progressively increased over the past year, with other sectors not showing the earnings decline that was feared earlier.

European markets were generally weaker over the June quarter, with European Union parliamentary elections producing a material swing to more right winged parties. This prompted the French President, Mr. Macron, to call a snap legislative election, which caused concerns on both French bond and equity markets. The French share market fell by 8.4%, with losses also recorded in Germany last quarter. The United Kingdom, which had its own election on July 4th, bucked the trend, finishing 3.6% higher.

The Japanese market also finished in negative territory, with the Nikkei Index falling 2.0%. Further weakness in the Japanese Yen (which has depreciated 11.1% against the $A over the past year), is placing some pressure on the Bank of Japan to increase interest rates from abnormally low levels as their domestic inflation shifts higher. Japan’s 10-year bond yield rose above 1%, which is the highest level for 11 years and reflects the expectation that Japanese monetary policy will be tightened.

Emerging economy share markets were mixed over the quarter. There were strong performances from India (up 9.9%) and Taiwan (up 16.3%). However, these gains were partially offset by a 2.6% fall in China, where concerns over the economic growth outlook are ongoing. This weaker Chinese growth outlook resulted in declines on some commodity markets, which also resulted in negative results from most South American markets. None-the-less, the overall MSCI Emerging Markets Index still finished in positive territory over the quarter with a gain of 2.6%.

With bond yields moving higher over the quarter, there was a sell-off on listed property markets. Global listed property finished 2.0% lower, with the Australian property sector declining 5.7%. Infrastructure, however, proved less sensitive to bonds yields and moved 2.3% higher.

Australian Equities

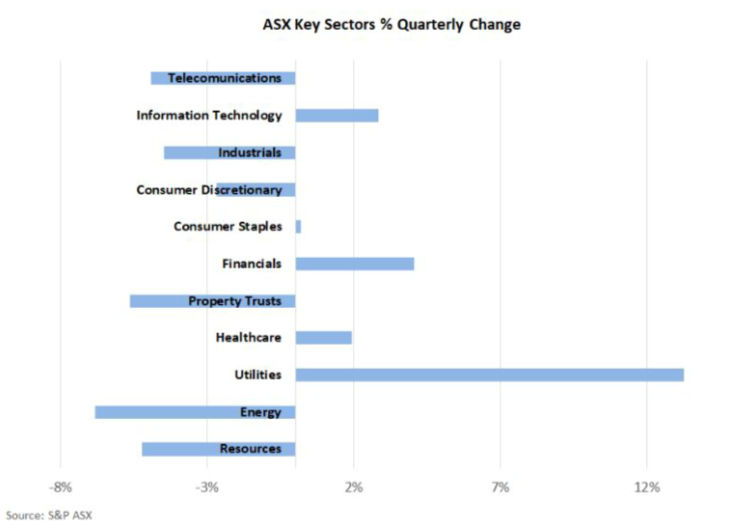

The Australian share market continued its underperformance against global average last quarter, with the S&P ASX 200 Index falling by 1.1%.

Resource stocks were a major contributor to the underperformance. A 2.9% reduction in the iron ore price led to falls across the major mining

companies. Other sectors showed mixed results, with the finance sector making the largest positive contribution.

Both banks and insurance companies were well supported, with Insurance Australia Group (IAG) jumping 12% following news of favourable reinsurance deals being secured. There was a particularly strong performance from the Utilities sectors, with the sector’s 13.3% increase being largely attributable to AGL Energy, which rallied 30%.

Fixed Interest and Currencies

The direction of yields on bond markets continued to be set by the outlook for U.S. inflation. Bond yields rose in April following higher than expected inflation, but then declined in the following two months.

Despite the more favourable U.S. inflation results in May and June, U.S. 10-year Treasury Bond yields still finished the quarter higher, rising from 4.21% to 4.36%.

There was a more significant increase in the Australian equivalent, with the 10-year yield here moving from 3.96% to 4.35%. Conditions on credit markets remained favourable, with an absence of any significant rise in corporate defaults. Higher credit security returns offset some of the small capital loss generated from rising bond yields last quarter.

Although there was no change in cash interest rates in Australia or the U.S. last quarter, there were policy reductions announced in the European Union, Canada, and Switzerland. Locally, there was more market participants predicting a cash rate increase by the Australian Reserve Bank this year because of higher-than-expected inflation indicator data for the month of May.

Despite some weakening in commodity prices, the $A held its value last quarter, rising from US 65.3 cents to U.S. 66.2 cents. Gains against both the Yen and Euro were more impressive, with the $A’s appreciation being 7.8% and 2.7% respectively.

However, trade fundamentals may become less supportive for the $A, with the Current Account moving into a deficit position in the March quarter. A weakening in the Terms of Trade (the ratio of change in export prices to import prices) was also contained in the Commonwealth Government’s Budget forecasts made in May.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR, MSCI World ex Australia NR Hdg AUD, FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A- REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HKD, MSCI United Kingdom TR in GBP, Nikkei 225 in JPY, S&P 500 TR in USD.

General Advice Disclaimer

This document has been prepared by Sage Advisers. Sage Advisers is a Corporate Authorized Representative of Sage Advisers Pty Ltd (AFSL 238039). Any advice provided is of a general nature and does not take into account personal circumstances. Any decision to invest in products mentioned in this document should only be made after reviewing the relevant Product Disclosure Statements. Should the reader wish to avail of using the above investment philosophy they should only do so firstly seeking personal financial advice through a financial planner. Past performance is not a reliable indicator of future

performance.

Comments